irs tax levy calculator

A tax levy is the next step in the collection process after a tax lien and occurs when the IRS seizes your property to pay taxes owed. CDOR will usually send a.

The IRS encourages everyone to use the Tax Withholding Estimator to perform a paycheck checkup.

. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. The IRS provides a wage garnishment calculator to determine the correct amount of wages to be withheld from an employees paycheck. The penalty is 05 of the additional tax amount due and not paid by the due date for every month or portion thereof that the additional tax amount is not paid.

What is the IRS tax levy calculation. Follow steps 1-4 to calculate disposable pay. In order to use our free online IRS Interest Calculator simply enter how much tax it is that you owe without the addition of your penalties as interest is not charged on.

The Notice of Intent to Levy is issued as per. This will help you make sure you have the right amount of tax withheld. Tax Help Has Arrived.

It is different from a lien while a lien makes a claim to your assets as. For employers and employees - Use the calculator to determine the correct withholding amount for wage garnishments. However the IRS still accepts these types of payment plans despite the lack of public notice.

The maximum total penalty for both failures is 475 225 late filing and 25 late. This Tax Return and Refund Estimator is currently based on 2021 tax tables. Prepare and e-File your 2021.

Trial calculations for tax owed per return over 750 and under 20000. In order to calculate the minimum monthly payment under this program. To learn more about how OORAA Debt Relief provides debt settlement and get your free debt evaluation please call at 888 888 9914.

Calculate Social Security tax at 42 percent of gross income and Medicare tax at 145 percent. With a tax levy the IRS confiscates assets of yours such as the money in your savings account or a portion of your wages. Ad Have State Levy.

Get Tax Relief That You Deserve With ECG Tax Pros. The IRS can take as much as 70 of. It will be updated with 2023 tax year data as soon the data is available from the IRS.

The IRS may levy a variety of assets. How to Calculate Wage Tax Levy. A tax levy is a legal seizure on wages to satisfy a tax debt.

One year for 120. Want Zero Balance Fresh Start. Release State Tax Levy Fast.

You will need a copy of all garnishments issued for each employee. It can garnish wages take money in your bank or other financial account seize and sell your vehicle. Thus the combined penalty is 5 45 late filing and 05 late payment per month.

An IRS levy permits the legal seizure of your property to satisfy a tax debt. The Department may issue a tax levy against the wages of any taxpayer who has failed to pay their taxes after a Final Notice and Demand for Payment is issued. Enter dollar amounts without commas or.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. A tax levy is when the IRS places a fine on a taxpayers assets or property due to unpaid tax debt. The penalty for not doing your taxes is typically around 5 of the tax you owe increasing by 5 each month until reaching a maximum failure to file penalty of 25.

An IRS tax levy is a legal seizure of your property to compensate for your tax. Of course an IRS levy doesnt happen overnight. Use the IRS Circular Es tax withholding tables to calculate federal income tax.

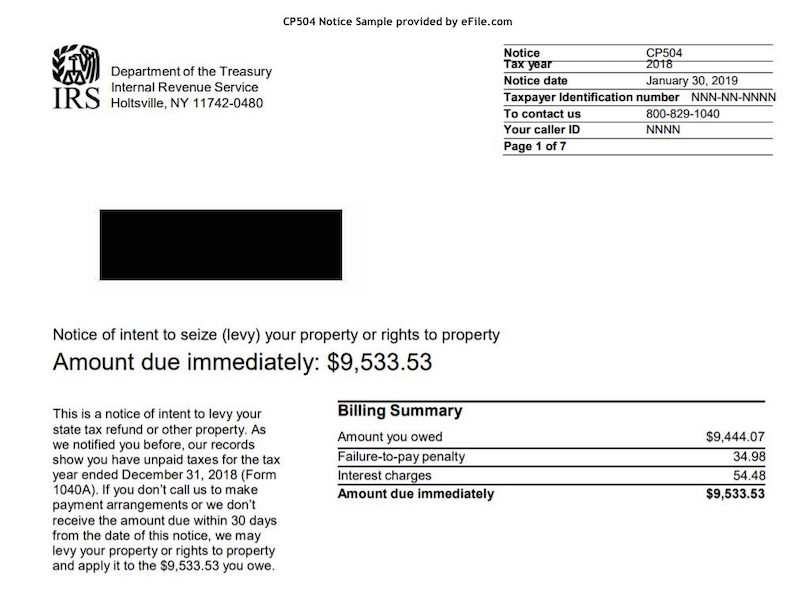

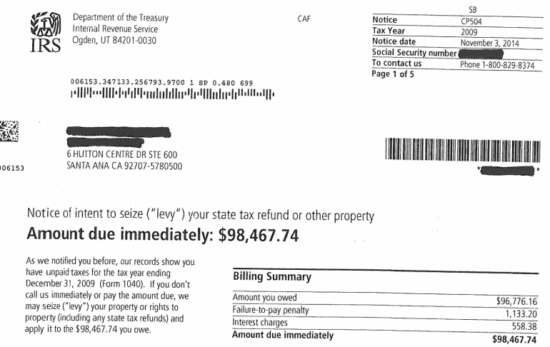

IRS issues Notice of Intent to Levy in a letter numbered CP504 asking you to pay the tax due within 10 days of service of that letter. Pay Period Frequency select one Select from below. Employers generally have at least one full pay period after receiving a notice of levy on wages.

As an employer when you receive a notice of levy from the federal government youll need to calculate the amount of the employees pay.

Should You Move To A State With No Income Tax Forbes Advisor

Irs Tax Brackets Here S How Much You Ll Pay In 2021 On What You Earned In 2020

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

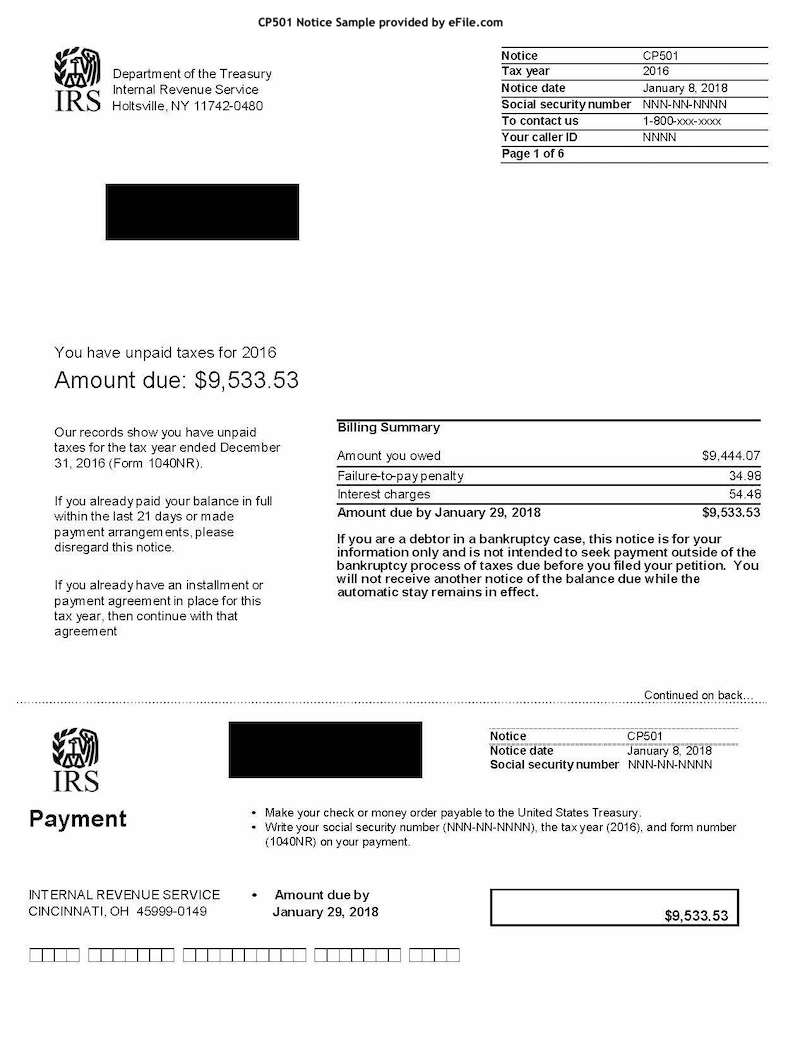

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

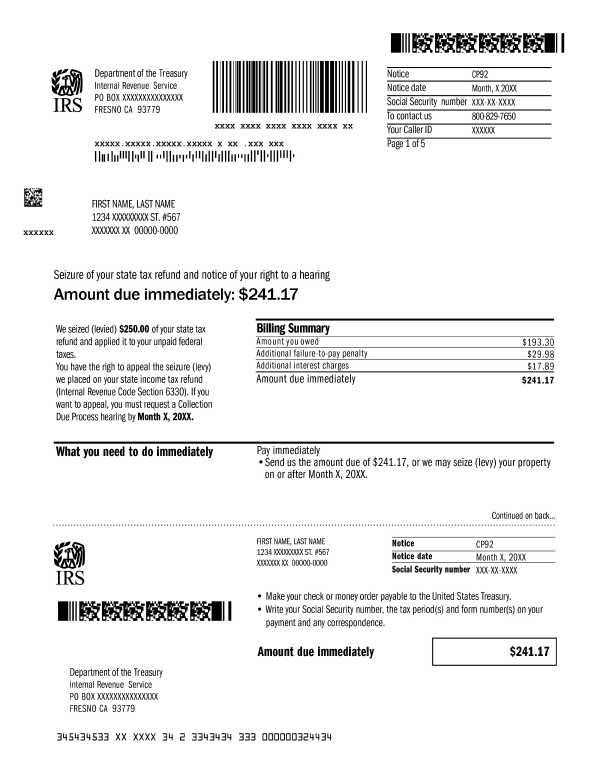

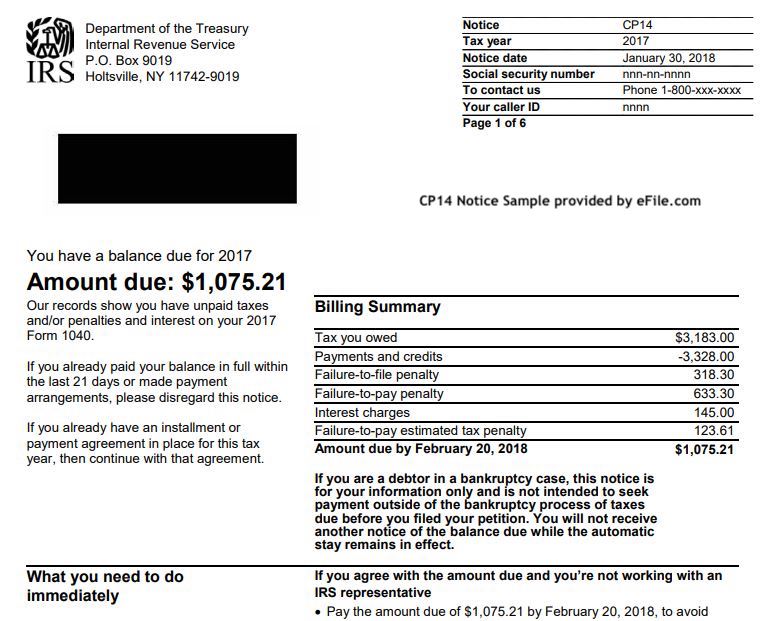

Irs Tax Notices Explained Landmark Tax Group

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Winchester Va Irs Tax Problems Help Kilmer Associates Cpa P C

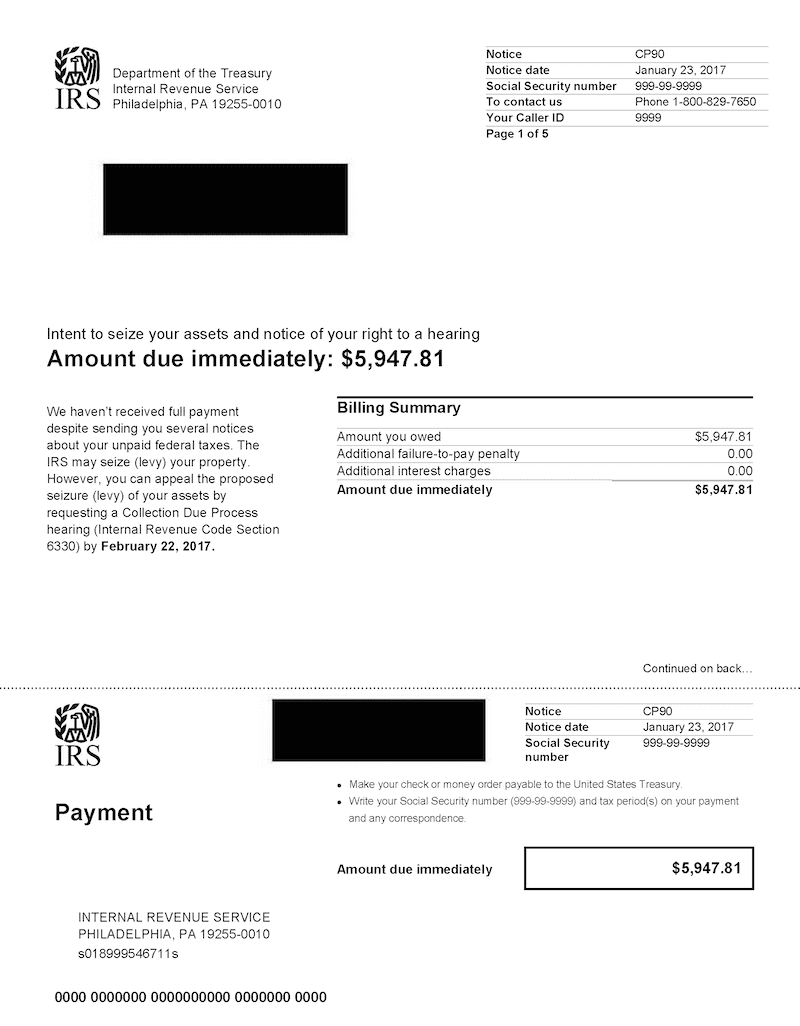

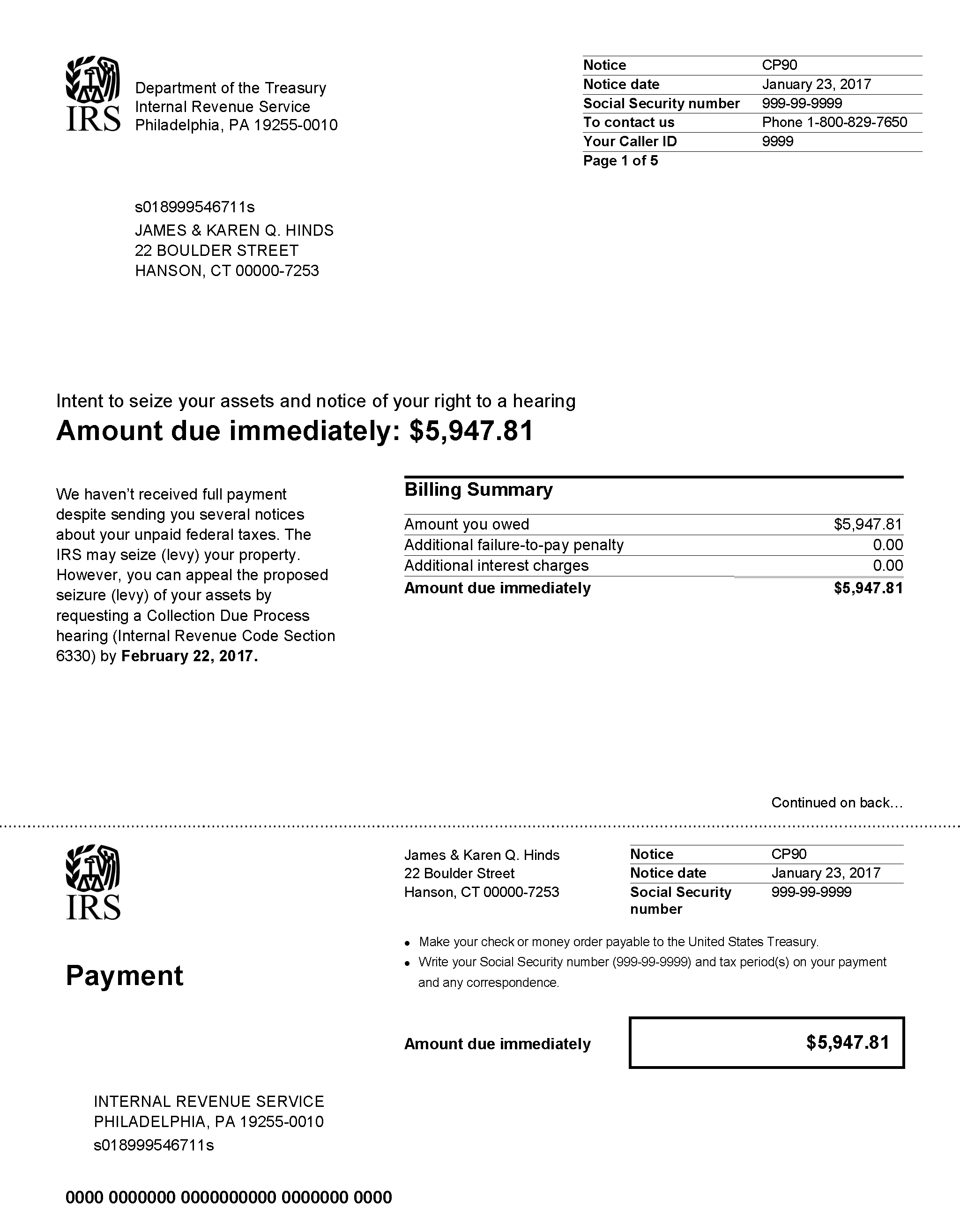

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Who Do I Call About An Irs Tax Levy

Irs Tax Resolution Oklahoma City Back Tax Returns Tax Debt Relief

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Understanding The Economic Effects Of Federal Tax Changes Equitable Growth